This document is provided for general informational purposes only and does not constitute investment advice. The information contained in this document has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions and estimates expressed in this document are as of the date of publication unless otherwise indicated, and are subject to change. The CIBC logo is a registered trademark of CIBC. The material and its contents may not be reproduced without the express written consent of CIBC.

Trademarks

Author's disclaimers

This article is for informational and educational purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This article’s site page contains links to other sites that BMO Global Asset Management does not own or operate. Also, links to sites that BMO Global Asset Management owns or operates may be featured on third-party websites on which we advertise, or in instances that we have not endorsed. Links to other websites or references to products, services or publications other than those of BMO Global Asset Management on this page do not imply the endorsement or approval of such websites, products, services or publication by BMO Global Asset Management. We do not manage, and we are not responsible for, the digital marketing and cookie practices of third parties. The linked websites have separate and independent privacy statements, notices and terms of use, which we recommend you read carefully.

Any content from or links to a third-party website are not reviewed or endorsed by us. You use any external websites or third-party content at your own risk. Accordingly, we disclaim any responsibility for them.

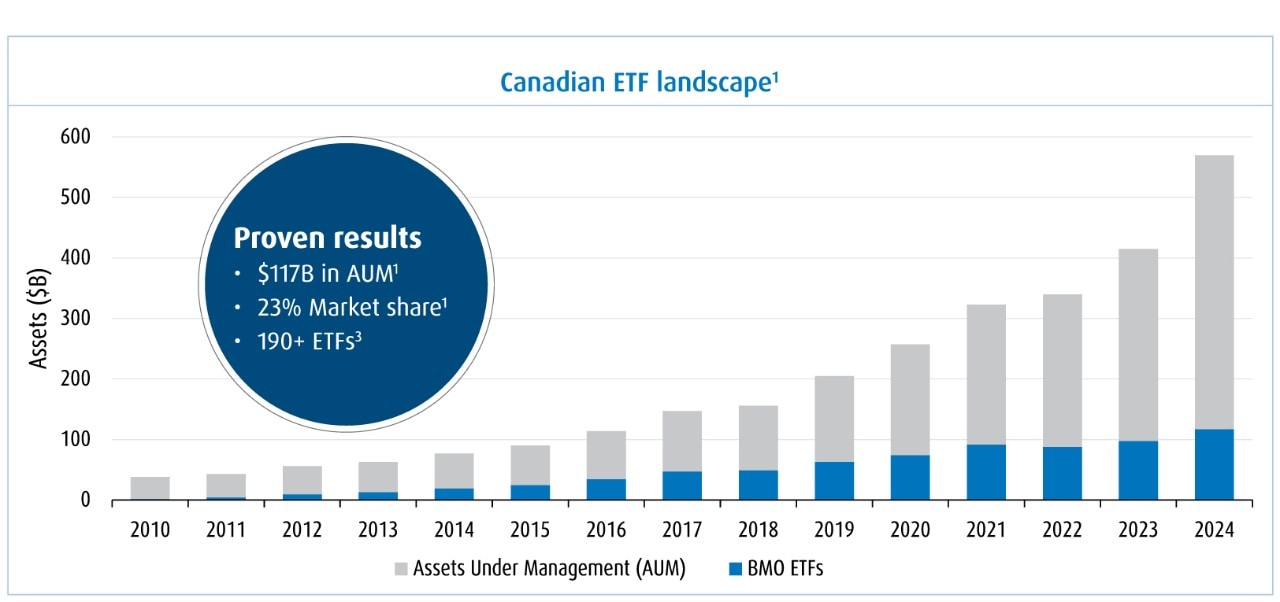

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

First published: July 2025