Understanding trailing stop limit orders

Want to know more about trailing stop limit orders? Take a look at our guide for a quick explanation.

CIBC Investor’s Edge

Aug. 08, 2025

5-minute read

How can you potentially protect your profits and minimize your losses in volatile markets?

You want to benefit as your stock moves higher and you’re willing to wait for your gain, but you think that’s unlikely to happen immediately. While you’re waiting, the price will rise and fall. After all, no stock goes straight up. That’s a normal part of stock market movement.

It can be painful to see a gain evaporate or even turn into a loss. You might be willing to tolerate a certain amount of movement against you, but you’d like to control how much.

There’s a type of order to help give you some control — the trailing stop limit order.

How does a trailing stop limit order work?

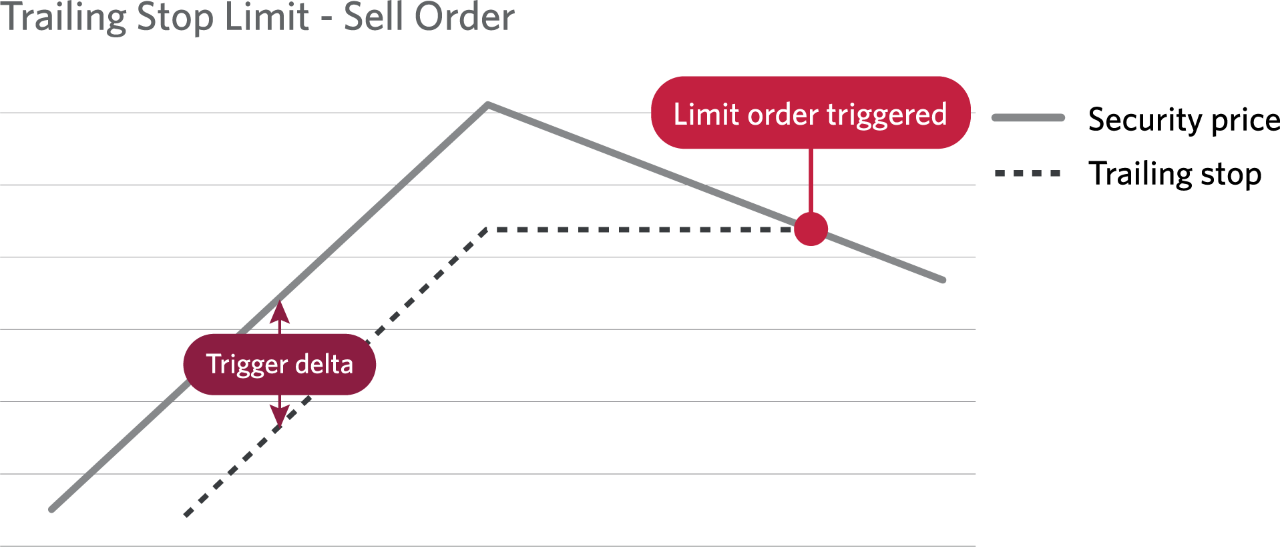

A trailing stop limit order allows you to set a trigger delta, which is how much the market price could fall before you’d want to sell, or rise before you’d want to buy. You can specify this as a percentage or a dollar amount. Once you set the trigger delta, Investor’s Edge continuously recalculates the price that will trigger your order, based on the stock’s current market price as it moves in a favourable direction — rising for a sell order, falling for a buy order. When the market price changes directions, your trigger price doesn’t change.

When your order is triggered, the sale or purchase of a stock will be a limit order. You determine the limit price by specifying how far from the trigger price you’ll allow your sale or purchase to take place. This is called the limit offset.

Note: Trailing stop limit orders are only valid during regular trading hours and won’t trigger in extended hours. This applies to both buy and sell orders, including all the following scenarios.

Why use a trailing stop limit order?

The sell trailing stop limit order can be used to build discipline into your trading strategy by providing a way to benefit from potentially higher upside prices, while specifying a limit on the potential downside prices of a stock. It lets you accomplish this without continuously watching the price of the stock.

A buy trailing stop limit order is the mirror image of a sell order. It can be used to protect profits generated through short selling or when trying to buy a stock that is bouncing off a market low.

You’ll want to look out for the kind of volatility that could move past your trigger price or limit offset without filling your order.

The market price of a stock with high volatility could move in one direction through your trigger price and your limit price. For a sell order, this means that the price could keep dropping without filling your order and your losses will not be minimized. For a buy order, this means that your order will not be filled despite the price moving higher than you expected.

It is also possible that a volatile stock could move in one direction through your trigger price and then quickly change direction on the same day. For a sell order, this means your limit order would be triggered and possibly filled, even if the market price ends up closing at the same price or higher than it opened. For a buy order, your order would be triggered even if the market price closes at the same or lower price than it opened.

First, you’ll look at the current market price of a stock and decide how much that price could fall before you’d want to sell. Then, you set your trigger delta:

- If the price falls 5%, I want to sell

- If the price falls $5, I want to sell

Investor’s Edge calculates the price that will trigger your sell order based on the stock’s current market price. This trigger price is recalculated as the market price rises. The trigger price does not change when the market price falls.

The trigger is there to help limit your downward moving sell price and if it was recalculated as the stock price falls, your sell order would never be triggered.

Your sell order will be triggered as a limit order. You determine the limit price by specifying how far from the trigger price you’ll allow the sale of your stock to take place. This is called the limit offset.

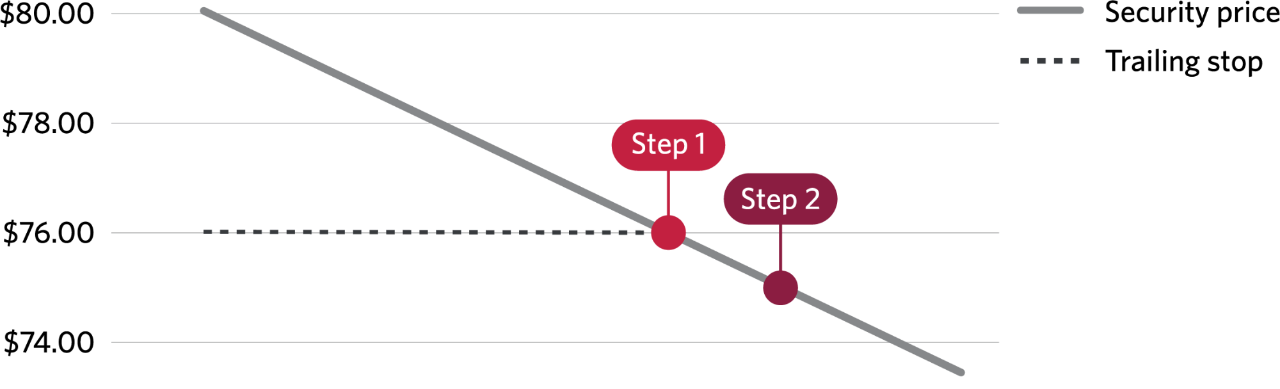

Scenario 1: Price goes down

Step 1 — The sell trigger

- A stock is trading at $80.00

- You choose a 5% trigger delta

- Your sell order will be triggered if the market price falls to $76.00 ($80.00 - 5% = $76.00)

Step 2 — Sale at a limit price

- Your sell order is triggered at $76.00

- You chose a $1.00 limit offset

- The limit price for your sell order is $75.00 ($76.00 - $1.00 = $75.00)

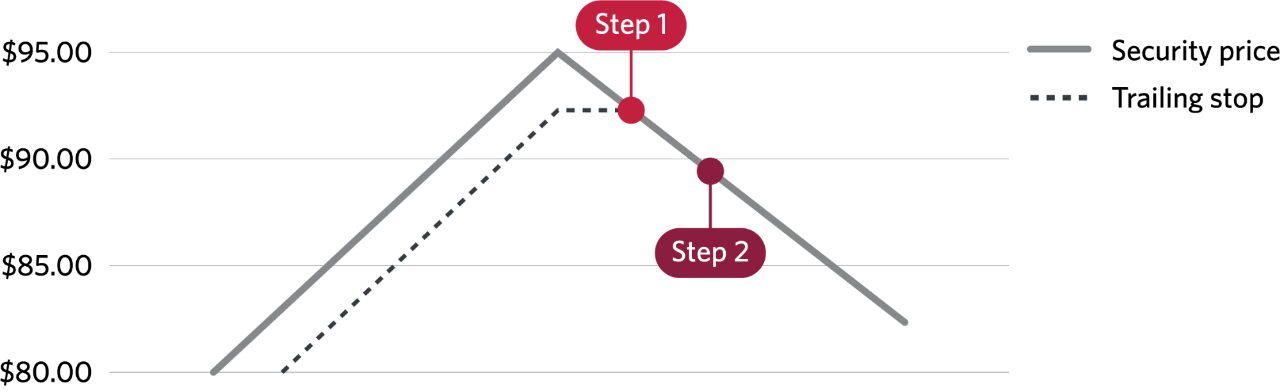

Scenario 2: Price goes up

Step 1 — The sell trigger

- The stock price increases to $95.00

- Your sell order is triggered if the market price falls to $90.25 ($95.00 - 5% = $90.25)

Step 2 — Sale at a limit price

- Your sell order is triggered at $90.25

- You chose a $1.00 limit offset

- The limit price for your stock is $89.25 ($90.25 - $1.00 = $89.25)

With a limit order, you’ll sell all or part of your position at your limit price or better, or you won’t sell at all. This protects you from selling into a market that is falling quickly, where your executed price could be much lower than your trigger price. However, the downside is that you may not sell at all, or only sell part of your position, and the price of the stock could move even lower. For example, in Scenario 1, if the price suddenly drops lower than $75.00 before your sell order can be filled, there will be no sale at your limit price.

This is the reverse of the sell order. You’ll look at the current market price of a stock and decide how much that price could rise before you’d want to buy. This is your trigger delta:

- If the price rises 5%, I want to buy

- If the price rises $5, I want to buy

Investor’s Edge calculates the price that will trigger your buy order, based on the stock’s current market price. The trigger price is recalculated as the market price falls. The trigger price does not change when the market price rises.

Your buy order will be triggered as a limit order. You determine the limit price by specifying how far from the trigger price you’ll allow the purchase of your stock to take place. This is called the limit offset.

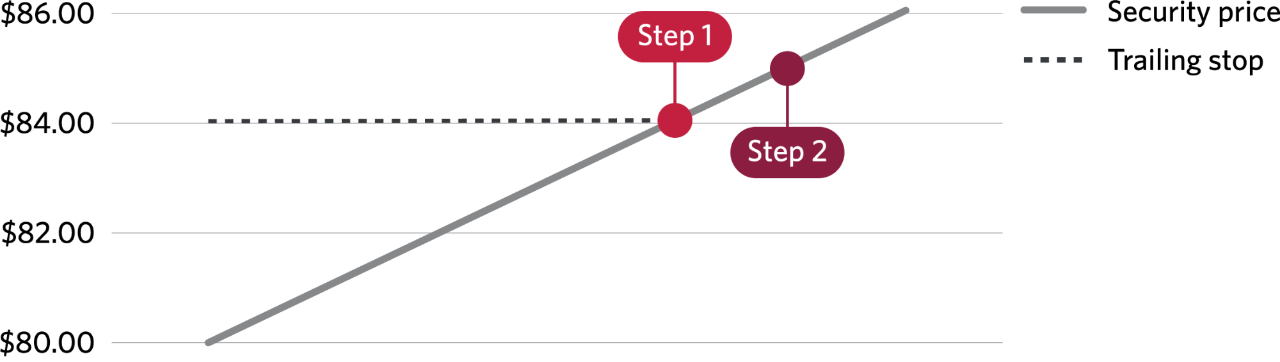

Scenario 1: Price goes up

Step 1 — The buy trigger

- A stock is trading at $80.00

- You choose a 5% trigger delta

- Your buy order will be triggered if the market price increases to $84.00 ($80.00 + 5% = $84.00)

Step 2 — Buy at a limit price

- Your buy order is triggered at $84.00

- You chose a $1.00 limit offset

- The limit price for your stock is $85.00 ($84 + $1.00 = $85.00)

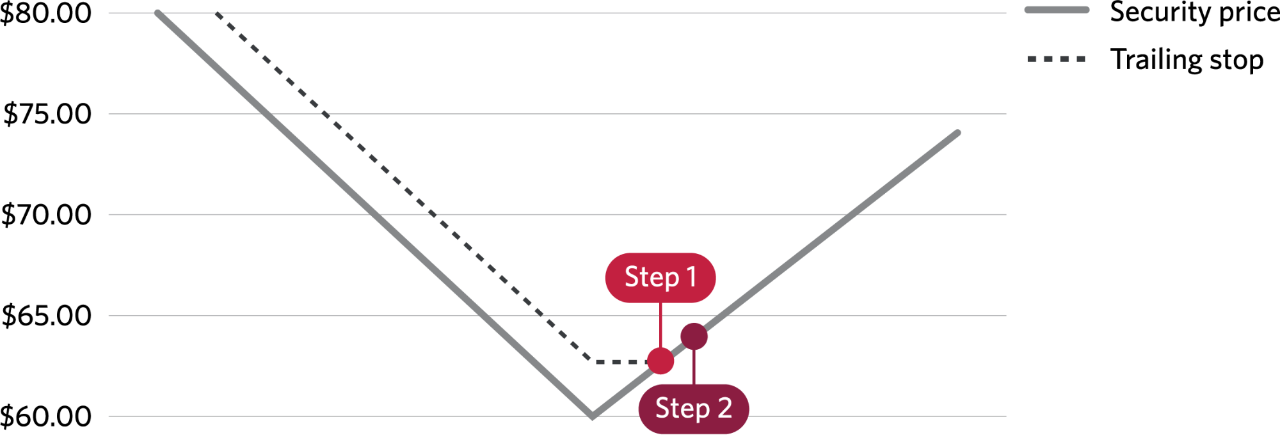

Scenario 2: Price goes down

Step 1 — The buy trigger

- The stock falls to $60.00

- Your buy order is triggered if the market price increases to $63.00 ($60.00 + 5% = $63.00)

Step 2 — Buy at a limit price

- Your buy order is triggered at $63.00

- You chose a $1.00 limit offset

- The limit price for your stock is $64.00 ($63.00 + $1.00 = $64.00)

With a limit order you’ll buy all or part of your order at your limit price or better, or you won’t buy at all. This protects you from buying into a market that is rising quickly, where your executed price could be much higher than your trigger price. However, the downside is that you may not buy at all, or only buy part of your position, and the price of the stock could move even higher. For example, in Scenario 2, if the price suddenly rises higher than $64.00 before your buy order can be filled, then there will be no buy at your limit price.