Find out how these notes have a potential to provide a fixed return while also providing contingent principal protection.

Jul. 26, 2025

What are autocallable buffer notes?

Key features

Key benefits and considerations

Payout overview

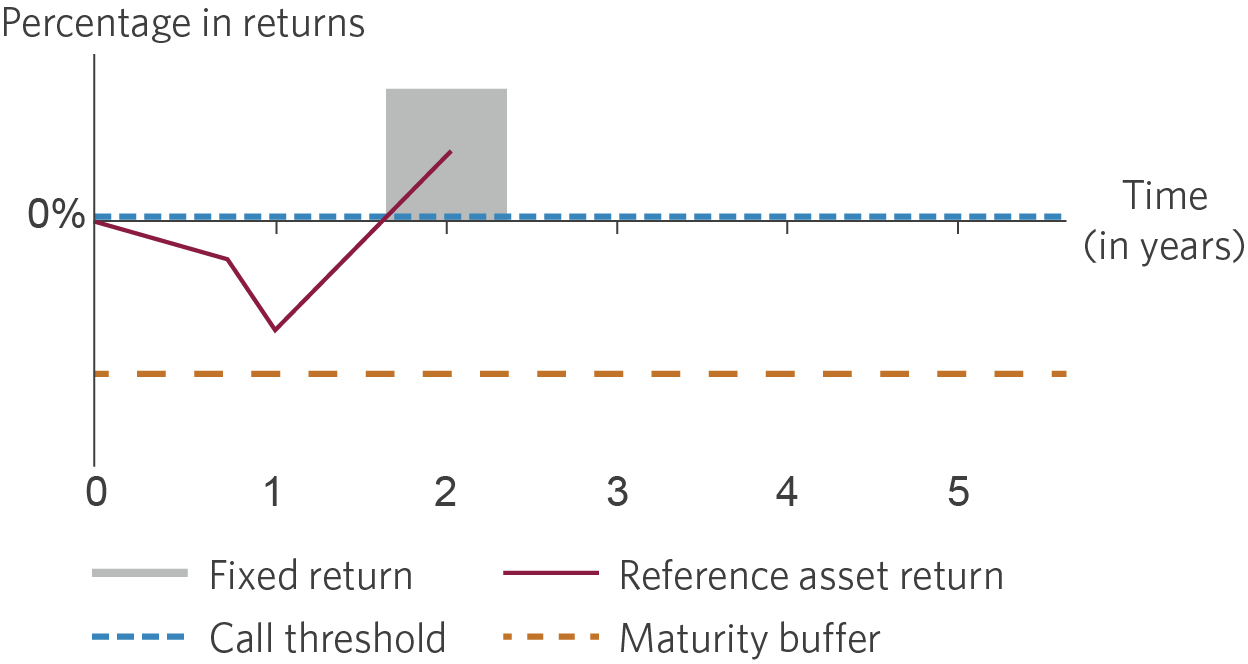

Case 1: Reference asset return is greater than or equal to the call threshold 0% on a valuation date prior to maturity.

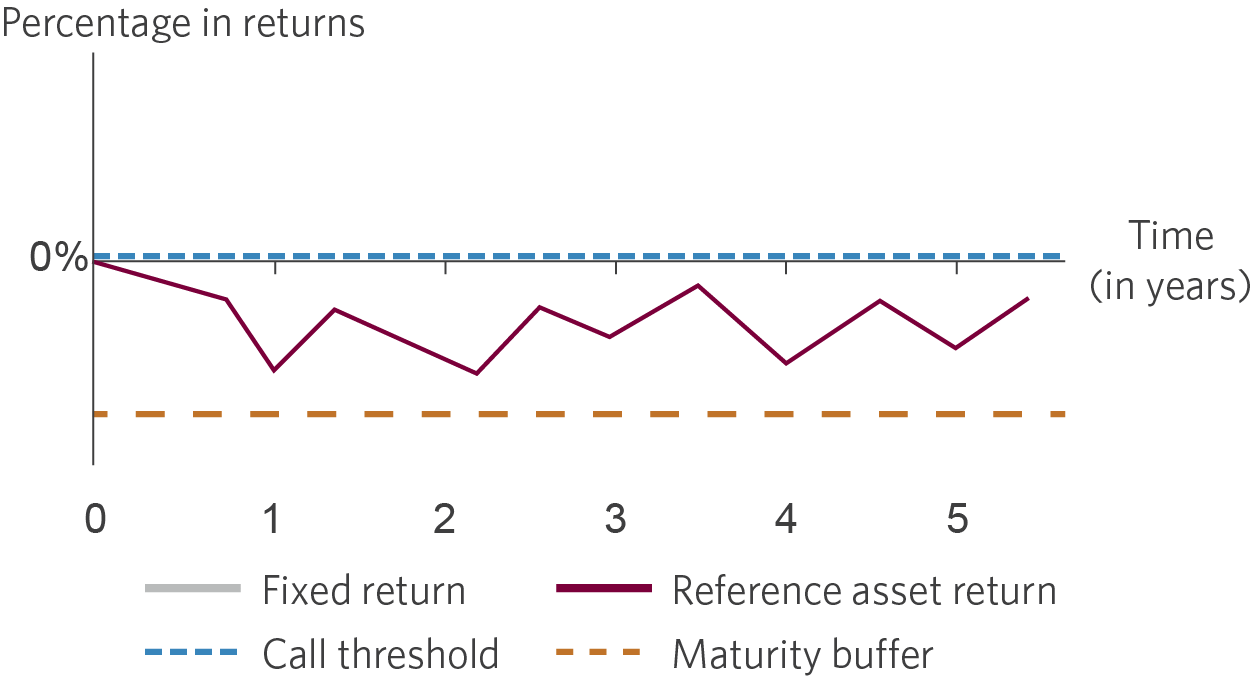

Case 2: Reference asset return is negative at maturity but buffer is not breached.

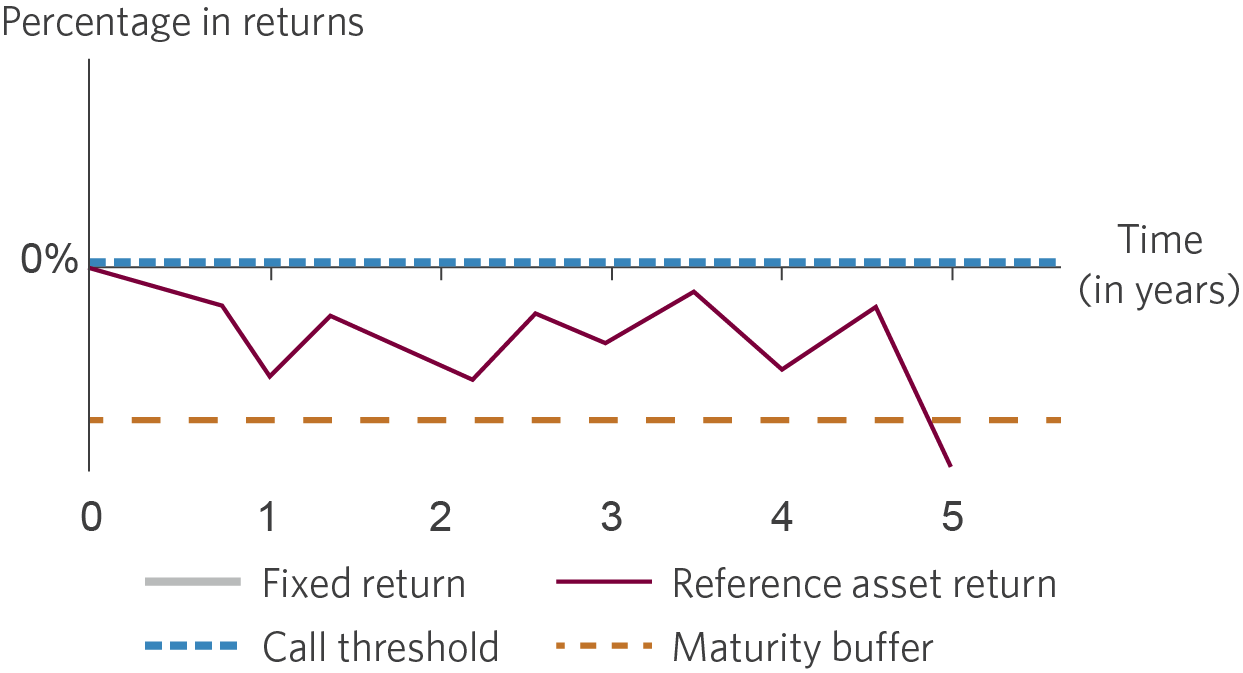

Case 3: Reference asset return is negative at maturity and buffer is breached.

Hypothetical maturity amount calculations

Example #1: Reference asset return is greater than the call threshold in year 1

Example #2: Reference asset return is greater than the applicable fixed return at maturity

Example #3: Reference asset return is less than the applicable fixed return at maturity but buffer is breached

Example #4: Reference asset return is less than the applicable fixed return at maturity and buffer is not breached

Knowledge is your most valuable asset

Explore more topics